Estate Planning

Planning for the transfer of assets at death is a critical element of retirement planning especially if there are survivors who are dependent upon the assets for their financial security. Planning for estate transfer can be as simple as drafting a will, which is essential to ensure that assets are transferred according to the wishes of the decedent. Larger estates may be confronted with settlement costs and sizable death taxes which could force liquidation if the proper planning is not done. The key to estate planning is leaving a legacy, knowing you’re providing for your family when you are no longer around. Whether it’s creating a tax free income stream or a lump sum, we can help.

Leaving a Legacy, Not an Excuse

Peace of mind in retirement comes from Estate Planning that AVOIDS Market Loss.

Wall Street does a great job of convincing people that risking money in the stock market is the best way to grow wealth.

Ever heard this piece of Wall Street doctrine: “When you are young you can afford to take losses, because you have time to recover.”

Would it surprise you to learn that this advice may not be in your best interest? Wall Street’s influence is so powerful that if they repeat the same doctrine over and over again, people eventually believe it’s a fact.

Losses are never good, but they can be especially costly the younger you are because of the opportunity cost. You lose the ability to have that money working for you for the rest of your life.

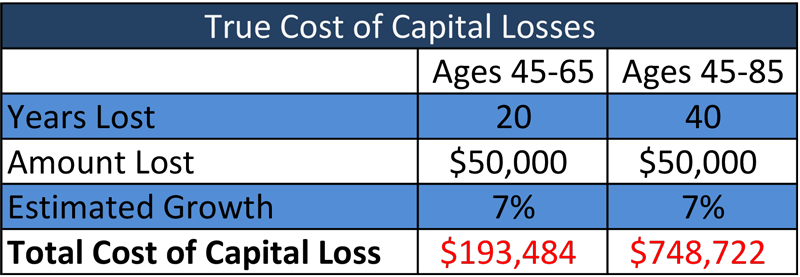

Take a look at the TRUE cost of a $50,000 stock market loss (HINT: It’s not just $50,000).

Let’s say you lose $50,000 in a market downturn when you are 45 years old. Let’s also assume you could have averaged 7% over the next 20 years (which you may be able to do with our strategies).

How much would this $50,000 loss cost you by the time you retire at 65?

The true cost of the $50,000 loss is $193,484.

But that’s not where it ends.

Let’s assume you live to age 85.

That $50,000 loss actually cost you $748,722 dollars. Your loss didn’t just cost you $50,000, it really cost you ¾ of a million dollars!